The space called “online video” is as broad as its players: online-advertisers, mobile technology, content creators, media properties, networks, cable-television providers, startups and individual YouTube “weblebrities.” But let’s not miss the fact that while I’ve been writing about “online video” for 5 plus years, I don’t likely have 5 more to go. As I mentioned in Beyond Viral’s chapter 18 (The Future of Online Video), we’ll soon return to calling video simply “video,” whether it’s on our computer, HDTV, mobile device or whatever else comes along.

Presumably my blog will migrate too, just as it has in the past. First it was “Revverberation” focusing strictly on the only 2005 revenue-sharing video property (Revver) to a site for amateur video creators looking to make a buck. Now it’s a blog I hope is relevant to a wider audience, such as online-video networks, digital agencies, online-advertising buyers and fellow marketers.

We “futurists” (dare I call myself one) typically fail by overestimating short-term changes but underestimating long-term ones. For instance most of my 2006 predictions came true… just not in 2007. I’ll crack out my annual crystal ball without reading Alex Rowland’s 2011 online-video predictions or any others. But when I’m done, I’ll add their links at the bottom and perhaps to substantiate or evolve my countdown of 2011 game changers.

So here’s not just what will happen in 2011, but what it means and why it matters.

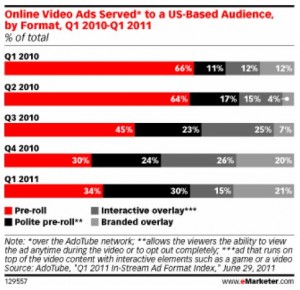

1) Here Comes the Money. Until 2009, marketers were concerned about placing ads anywhere near “consumer generated content.” In 2010, online-video advertising was the fastest-growing portion of a marketer’s mix. Advertisers are still scrutinizing reach (scale), targeting, and impact. But online-video ad spending forecasts are very positive, and it remains a “buyer’s market” for those media buyers willing to divert ad budgets into online video units. YouTube commands a ridiculously small CPM (cost per thousand views) relative to most properties, and demo-accuracy aside, is driving ROI for most brand pioneers (as measured by attention scores, direct response or “CPC,” recall, intent-to-purchase lifts and ultimately sales, where accurately tracked). Advertisers took many years to migrate dollars from offline to online, but most analyst reports are bullish on ad spending moving to online video (at the expense of offline media and lower-performing banners). So content creators (and media sites) who hold constant on monthly views will receive bigger checks. As an example, when I reluctantly turned on “pre-rolls” to my Nalts videos I saw my income increase significantly with no change to total views (still 4-6 million per month).

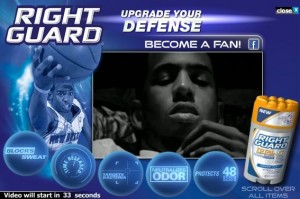

2) Bold New Online-Video Advertising Models: InStream or InVideo formats (small overlays on the bottom 20% of the online-video screen) was certainly more effective than adjacent banners, and a smart compromise to avoid charging for content. But the market is artificially depressed for these ads, and pre-rolls have become dangerously pervasive alternatives. I hope and trust that creators, advertisers and (quite importantly) video platforms will provide new formats that a) respect the viewer, b) complement the content, and c) ensure that ad message gets sufficient attention to command a fair price. Most importantly, the most innovative approaches will weave ad messages into the creative, and target with greater precision for a better return on advertising investments.

3) Experimentation With Ad-Free, Microcharge Pay-Per-View: Given how little ad-revenue generates per active view, I would expect some online-video creators (if platforms cooperate) to experiment with a token fee-based subscription models. If it was easy, I’d pay a small fixed or variable fee to avoid cursed pre-rolls before viewing online-videos by YouTube Partners. As long as an annoying preroll generates a fraction of a penny to YouTube and the Partner, it wouldn’t cost a viewer much to purchase immunity from them (while still keep the platform and creator “whole” on income). Imagine if YouTube offered viewers the ability to effectively self fund the content he/she consumes for a modest monthly fee based on the quantity of videos consumed. I realize 70-90% of online-video viewers would resent whipping out their wallets because they feel entitled to free content. So I wouldn’t expect this to explode, nor would I propose an “either/or” scenario. That said, I trust I’m not alone in saying that I’d rather pay $5 a month to enjoy all of my YouTube videos without interruption, and that’s all it would take to offset the ad revenue YouTube and its partners might otherwise generate. This has been proven on certain websites and apps (free with ads, small fee for ad-free) and could work in this medium… but it does require a PayPal or Google Checkouts to make this incredibly easy. Mac cracked the code with me and others by simply making the purchase/rent option so incredibly easy that pirating content is no longer worth it.

4) The Video “Screen” Becomes Less Important: For years we’ve anticipated the great collision of “lean forward” (computer) and “lean back” (television). It was going to fundamentally change the ecosystem and democratize content creation. Finally in 2010 you didn’t need an MIT PhD to enjoy digital video content without an antenna or a cable-television subscription. Of course this convergence, despite dramatic improvements in the past year, is still being enjoyed by fewer than 10% of Americans. Now we have three discreet segments of video consumers:

- Early adopters (we’re using home-rigged media centers, TiVo, GoogleTV, Roku, Boxee, AppleTV, and clumsy ethernet-enabled televisions.

- The lagging but vibrant “cable snipping” generation, which had a sudden epiphany during the past solar orbit, and believes Comcast, Verizon and Time Warner are “The Walking Dead” because content will forever remain free.

- The laggards who will enjoy subscribed, licensed, stolen or ala cart (on demand) video content via television, computer and mobile… only when their cable-TV provider makes it incredibly easy.

None of this matters terribly by itself. Sure our content via YouTube, Netflix, Hulu, iTunes, Cable “On Demand,” Amazon and other providers) is increasingly portable, and we’ll eventually carry our subscriptions on our primary mobile device (aka phone). Hooray! We’ll have the luxury of watching rented, purchased or “borrowed” Avatar film or Modern Family episodes continuously whether we’re on the couch, commuter train or our desktop (example: Xfinity or Dish Network’s “TV Everywhere“).

More importantly, we’ll prefer to consume different types of content via different screens, and that poses a challenge to content creators. For the most part, we’ll subscribe (free or paid) to most content that’s popular within our social networks (real or virtual). But we’ll search (usually in laptop-like mode) for “just in time” content, which may include quick “how to” videos or a clip we’ve heard is “going viral.” Demographics (age, region) and psychographics (behavioral) will dictate viewer preferences, so Paw Paw may watch Fox and CNN on her cable box, mom may surf her cable lineup, young urban adults may binge The Onion and College Humor on computers using HDTV as a monitor, and the teens and tweens can gorge semi-pro content like Barely Political and Annoying Orange from the privacy of their Smart Phones.

So what does this mean to the people who depend on audiences? Creators and advertisers will need to know their audiences better, and leverage different mediums and form factors (length of content and distribution strategy) to reach and satisfy them. We won’t see the end of niche creators with niche audiences whose needs can’t be met via more mainstream content (hot music, top comedy, the quirky clip that taps our collective consciousness). However these creators should take caution in mimicking the habits of the top talent, and instead focus on depth not breadth.

5) Transmedia Storytelling Grows Up: At September’s New York Television Festival (NYTVF) Digital Day, panelists discussed the challenge of “transmedia” storytelling. For these media executives, directors, creative types and writers, “online video” was one element of a storyline. Their challenge, unlike a web series like The Guild, is to leverage online-video to complement a story that is powered by a television show, but offers short-form web video as an optional “add on” to the experience. Previous television “webisodes” (like those of The Office, which were well promoted during the weekly television episodes) were largely isolated events. One could enjoy The Office without the webisodes, but hardcore viewers enjoyed the extra, independent plots. As more people are conveniently able to dive into a webisode from their television, it’s likely these previously “stand-alone” pieces of entertainment will serve a richer role in the narrative.

6) Independent Webisodes Get Second Chance. In the early days of online-video, there wasn’t a sufficient revenue model for well-produced webisodes that were fairly expensive to produce, but had trouble attracting audiences. Look for aggregators snatching some of the quality content at a low cost, and forging distribution deals to give them new life. Currently there are dozens of popular YouTube channels that meet the definition of “webisodes” (see a Mashable list of popular ones in 2010). But what about all the Streamy nominees featuring well-produced but sometimes starving comedic, drama or reality-show “webisodes”? Could the mercurial content from “Funny or Die” find a new and broader audience via well-promoted subscriptions via new devices? This provides new income to the show owners, unique content for audiences, and a powerful differentiator for the distribution platform. Roku, by example, provides easy access to Revision3 content, and that’s a free “value add” for Roku users that gives Revision3 shows (Film Riot, Scam School) a larger audience to attract advertisers.

7) The Amateur-Creator “Thinning of the Hurd.” The “amateur” talent pyramid has transformed from flat to tall, and almost no YouTube star has jolted into mainstream. Still, hundreds of lean amateurs have developed comfortable full-time jobs (six figures plus) as YouTube Partners in the past 18 months. The “weblebrity” lifecycle is shrinking (rapid rise and fall), with just a few dozen channels dominating the vast majority of views. This is no different from the maturing of any previous medium (radio, television, blogs, Indie music) because society can’t handle radical fragmentation of content. Shared media/entertainment is a social glue that forgets a common vocabulary, so it’s “survival of the fittest.” Even with occasional “overnight successes” (from Justin Bieber to the relatively small Shaycarls, iJustines and Wheezywaiters), we collective viewers struggle focusing on more than 20-50 different webstars or channels, and eventually the best 10% will own 90% of the views on YouTube — or emerging “democratic” mediums with relatively low barriers to entry. It happened with music, and it’s happening on YouTube, where the same 7-20 people are routinely dominating the daily “most popular” charts, and the “one-hit wonder” viral videos are celebrated and forgotten like a fad.

Now let’s look at some other online-video 2011 predictions to nail the final 3:

8) Social-Viewing and Curation. VidCompare invited some industry experts and platform owners to speculate on some coming trends. It’s a beefy list of predictions, but I’m summarizing two related predictions I found especially important (where italics are my own reactions to the assertions).

- Dramatic increase in social viewership drives innovation in social sharing techniques and measurement (Jeff Whatcott – SVP Marketing, Brightcove). An absolute in my opinion. Look no further than how Daneboe has used Annoying Orange’s popular Facebook identity to increase views on his YouTube videos.

- 2011 is the year we curate. The result of this massive explosion of content creation is that we are increasingly overwhelmed with choice. Too much content makes finding useful and relevant material increasingly difficult. In a world of unlimited choice, search fails. What we’ll see is a growing category of content curators – individuals, brands, and publishers. (Steve Rosenbaum – CEO, Magnify.net). Steve has always been ahead of the market, and curation is logical and desirable. I became introduced to the concept of video curation while writing my book, and see it as a natural and healthy progression of the medium.

- See more technology-oriented predictions on VidCompare, as well as observations on what geographic markets will drive growth, what major players (Amazon, NBC) will dominate, and how ad networks will face a squeeze.

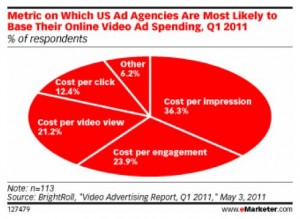

9) Cost Per Engagements: Speaking of ad networks, see what the leading providers are anticipating in 2011 (AdExchanger), including some interesting thoughts on CPE (cost per engagement) by Tremor Media’s CEO Bill Day. I like CPE better than CPM because I feel that impressions is a poor judge of online-video performance. What matters is how the viewer engaged, and what they did as a result of the video… even though that’s often missed by CPE.

10) Standard Wars, and Everyone’s a Media Company: Brightcove’s Jeremy Allaire wrote a nice TechCrunch article about standard wars, connected TVs and social recommendations.Well worth a read, as Allaire is standing in the middle of a separate part of this ecosystem that I don’t see first-hand.

Okay now your turn. What’d I miss? What did I call wrong? Let’s crowd-source our psychic powers and make the first 100% accurate technology predictions, shall we?