He’s the new GOVA Gavone. The leader of the online video association. The guy who’s scream silences a room.

AdWeek reports that Paul Kontonis, former online video producer and agency guy, is heading the new Global Online Video Association (GOVA). Kontonis has been a leader in the online video space from its inception, including such roles as founder of “For Your Imagination,” VP at Digitas’ Third Act, and chairman of International Academy of Web Television.

By day, Kontonis heads sales and strategy for one of the top “multichannel networks” (MCNs) called Collective Digital Studio. GOVA is made up of nine of the top MCNs (also called online-video studios and “new networks”). These include Collective, Maker Studios, Fullscreen, Big Frame, BroadbandTV, DECA, Discovery’s Revision3, Magnet Media and MiTu Networks. Machinima is conspicuously absent, but unlikely for long (it’s quite common for the biggest in an industry to initially think they don’t need an association).

Caveat: I know Kontonis and like him (which is why I am allowed to call him a gavone as a term of respect). He was even in one of my videos where I thought I turned invisible. But I haven’t spoken to him in a while and know nothing directly about his GOVA appointment. So this is all my speculation based on watching this space mature. And I wrote a book, so shut up.

What’s ahead, and what does GOVA mean to the networks and the maturing landscape of online video?

-

Susan Wojcicki, leader of YouTube, is focused on mainstream players. GOVA may help keep her attention on smaller studios. Bargaining Power with YouTube. The online-video networks, or “multichannel networks,” will now have a collective voice they’ll need more in coming years. That’s in part because YouTube, the virtual monopoly on distribution, is increasingly turning its attention to more mainstream studios and traditional networks. As YouTube grows, it will be increasingly difficult for individual studios to command the attention they’ve received in the past. How do we know that? History is the best predictor: Initially top YouTube stars could garner attention from Google and resolve issues. But eventually YouTube creators needed the power of a network. The networks don’t know it yet, but in years ahead they’ll need strength in greater numbers than they have today.

- Bumpy Road, Herding Cats. Associations can be tricky, as participants theoretically want a collective voice, but they’re also competing against each other for precious advertising dollars. Kontonis has shown he’s got the diplomacy and persuasion to herd these network cats.

-

GOVA may help keep emerging studios independent, which is good for “amateurs.” Could Slow Down Acquisitions. In the coming years, we’d expect to see more of these online-video networks get acquired by larger players. Discovery ate Revision3. Google ate Next New Networks. GOVA may give some of these players more time to play independently, if they wish, before the eventual consolidation of traditional and “multichannel” networks in the 2015-2020 period. That doesn’t mean the MCNs will be less attractive to acquiring parties, it just means they won’t be as desperate to be sold. That’s a very good thing for individual creators of these networks. (When they do get acquired, they’ll try to convince you it’s a good thing… but as a loyal WVFF reader you’ll know better).

-

GOVA can help negotiate with emerging video-playing technologies Developing Emerging Channels to Reduce Dependency on YouTube. As we look beyond YouTube, the major stakeholders are technology companies, advertisers, and content creators. Years ago, an individual studio could negotiate their video content onto new platforms — like we saw Revision3 do with Roku and College Humor do with TiVo. But that will be more difficult as stakes increase and traditional networks start seeing more meaningful “TV dollars” moving to emerging channels. This coordinated approach through GOVA will increase the studio’s voice with new platforms. Watch for GOVA serving a role to keep them “out in front” of new platforms — from Roku to Netflix and Hulu to Amazon. And more importantly, the emerging video distribution platforms we don’t yet see coming. Maybe one day even AppleTV!

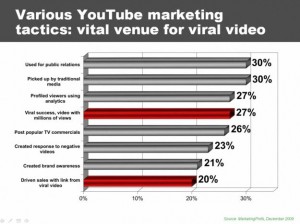

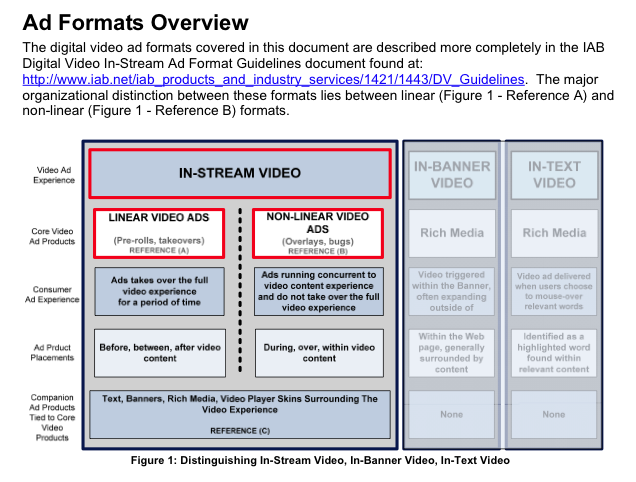

- Other Boring But Important Crap. GOVA can also help with legislation/regulation, advertising formats, metric standardization, growth of the online-video, and thought leadership. Depending on the issue, they will likely partner and challenge other players like IAB, ComScore, traditional media associations, and marketing agencies.

- Four More Years. That’s how long I see this lasting. By 2018, we’d expect GOVA to roll into the Internet Advertising Bureau, IRTS or some other association. But no other association has the knowledge of or focus on this medium.

- Bottom Line. Creators and studios need GOVA whether they know it or not. Otherwise the technology platforms and advertisers will set the agenda.